Can You Sell a Condemned House? The simple answer is yes. But, the process is a little more complicated than selling a typical standard house. Depending on each state, there are usually additional rules and regulations for selling condemned homes.

A condemned house or property typically signifies a structure that local government agencies have deemed unfit for habitation. This might be due to significant structural damage, public safety issues, or severe health hazards. Despite the ‘condemned status,’ selling a condemned house is still a feasible option.

Because of the additional laws and policies that oversee the sale of condemned homes, sellers usually find it difficult to successfully find a buyer or get the best value for their property. In this article, we’ll look at some common challenges that one might face when selling a condemned property, the processes involved in selling your condemned house, and where you can find interested buyers.

The Challenges of Selling a Condemned House

Navigating the sale of a condemned house can be a daunting task, presenting several unique challenges that homeowners typically do not encounter with standard property sales. Let’s delve into some of these key challenges:

1. Legal Hurdles

Legal issues are often at the forefront when selling a condemned house. These properties have been deemed unsafe or uninhabitable by local authorities due to various reasons such as severe structural problems, code violations, or hazardous living conditions. This condemnation often comes with legal constraints around selling, requiring the property to be brought up to code or demolished. Understanding and navigating these legalities can be complex and often require the assistance of a real estate lawyer.

2. Limited Buyer Pool

The market for condemned houses is significantly smaller compared to standard homes. Traditional buyers looking for a move-in ready home are typically not interested in condemned properties due to the extensive repairs required. This narrows the potential buyer pool primarily to real estate investors or house flippers who are willing to invest time and resources into making the property habitable again. On the other hand, it also means your potential buyers are usually highly motivated.

3. Financing Difficulties

Condemned houses are often considered high-risk investments, which makes securing financing for these properties a challenge. Most banks and traditional lenders shy away from offering mortgages for such properties. This necessitates finding buyers who are either cash buyers or those with access to alternate financing sources like private lenders.

4. Pricing Challenges

Setting a realistic and fair price for a condemned property can be difficult. The price must take into account the cost of repairs necessary to lift the condemned status. This involves a careful evaluation of the property’s condition, estimating repair costs, and comparing it with similar properties in the area.

5. Time and Resource Intensive

The process of selling a condemned house can be lengthy and resource-intensive. From getting a detailed report on the property’s condition to negotiating with potential buyers willing to take on a substantial project, selling a condemned house can be more time-consuming than a standard property sale.

Despite these challenges, selling a condemned house is not an impossible task. It requires a strategic approach, patience, and often, professional assistance. With the right guidance and resources, homeowners can navigate these obstacles and successfully complete the sale.

Understanding Condemned Houses

As mentioned earlier, condemned houses come with their own set of rules and restrictions for property owners. Selling a condemned house involves navigating these rules, understanding the condemnation process, and making potential buyers aware of the property’s status.

The market for condemned properties is typically made up of real estate investors and house flippers who have the means and expertise to renovate or demolish and rebuild such properties. These buyers, often referred to as cash buyers, usually make a fair cash offer to buy condemned houses. They are often equipped with a network of private lenders, allowing them to pay cash swiftly, which can be an attractive proposition for a property owner looking to sell a condemned property.

If you need support selling your condemned house, My Tennessee Home Solutions is a team of professional cash buyers who can guide you through the entire process. Reach out to our team today, and we’ll make you a fast and fair cash offer on your condemned house!

Is it Legal to Sell a Condemned House?

The legality of selling a condemned house can be a straightforward matter – if you choose to sell to knowledgeable cash buyers who understand the process. While it is not illegal to sell such a property, there are specific regulations and guidelines property owners must follow. These guidelines often concern resolving code and safety violations that led to the house being considered condemned in the first place.

Lenders’ concerns also play a significant role in the legality of selling a condemned house. Traditional lenders and banks are typically reluctant to finance the purchase of a condemned house due to the high risk associated with such properties. Therefore, the potential buyer pool for condemned houses often consists of cash buyers such as real estate investors who can bypass traditional financing.

The Process of Selling Condemned Houses

It is crucial to thoroughly understand the local legal landscape and take steps to meet all requirements before selling a condemned home. When done right, selling a condemned house can turn into a profitable venture while also contributing positively to neighborhood rejuvenation.

It’s important to note that, for a property deemed unfit for living, the market value could be lower than that of a similar property in a habitable condition. This difference in value is often a focal point during negotiations and must be transparently communicated to potential buyers to ensure a legal and fair transaction.

The process of selling a condemned house involves several intricate steps that need to be undertaken with meticulous attention. This process may seem daunting, especially for those unfamiliar with such transactions, but with the right information and resources, it can be manageable and even profitable. Let’s explore this process in detail:

1. Understanding the Condemnation Status

Initially, it’s essential to fully understand why the house has been deemed unsafe or unfit and hence, considered condemned. For instance, a property may be condemned due to substantial structural problems such as a crumbling foundation or environmental hazards like mold infestations. Alternatively, it could be due to violations of local building codes, such as unauthorized extensions or alterations. In any case, a homeowner should request a detailed condemnation report from the local government agency responsible for the property’s condemned status. This report will elucidate the reasons behind the condemnation, providing a starting point for further action.

2. Determining the Market Value

The market value of a condemned house is often drastically lower than that of other properties in habitable conditions. Suppose you have a property in Nashville, TN, where the average home price is around $300,000. In contrast, a condemned house in the same area might only be worth a fraction of this price due to the extensive repair work required to make it habitable. An appraisal by a certified real estate professional can help assess the property’s actual market value, factoring in these unique circumstances.

3. Navigating Lenders’ Concerns

Traditional lenders, such as banks and credit unions, often perceive condemned properties as high-risk investments. They are usually reluctant to finance such purchases. Consequently, your likely buyers might be real estate investors who specialize in purchasing, renovating, or even rebuilding such properties. These investors often have access to alternative financing options such as private lenders or have the capacity to offer cash deals.

4. Marketing the Property

After evaluating the property’s market value and recognizing your potential buyers, it’s time to list your property. The listing must explicitly state the property’s condemned status and should disclose any known issues to ensure transparency. You could also reach out to real estate agents or investors who specialize in such properties. For instance, an investor who has previously converted a condemned property into a valuable real estate asset could be interested in a similar project.

5. Finalizing the Sale

Once you find a buyer, the final stage is closing the sale. This phase can be slightly more convoluted for condemned houses compared to regular real estate transactions. For example, there may be extra-legal considerations or inspections required by the local authorities. Having an experienced real estate attorney or agent can help navigate these complexities, ensuring the sale process concludes smoothly.

Potential Buyers for Your Condemned House

Selling a condemned house can seem like a daunting task due to the unique challenges that it presents. However, there is a specific group of potential buyers who are interested in such properties. Let’s delve into who these buyers might be:

- Cash Home Buyers: This is perhaps the most common category of buyers for condemned houses. Cash home buyers often look for properties that they can refurbish and resell. Selling your condemned home to a professional cash buyer like My Tennessee Home Solution can make the home sale process significantly easier to manage than searching for a buyer on the market.

Our experts are here to support you from start to finish, streamlining the sale process, and offering you a fair cash offer on your schedule. Get in touch with our team to learn more about how we can help you sell your condemned house today!

- House Flippers: Closely related to real estate investors are house flippers. These are individuals or companies who purchase properties in poor condition with the sole intent of repairing and reselling them quickly. A condemned house, with its requirement for substantial improvements, can present an ideal project for house flippers.

- Property Developers: In some cases, property developers may be interested in purchasing a condemned house. If the property is in a desirable location, developers might buy it to demolish the existing structure and build a new one. This could be a single-family home or a multi-unit structure, depending on zoning laws and market demand in the area.

- Private Buyers: While less common, some private buyers may be interested in a condemned property. These are often individuals who have the resources and time to invest in extensive renovations. They might be motivated by the potential for a lower purchase price, the ability to customize the home to their preference, or the appeal of a particular location.

- Non-Profit Organizations: Some non-profit organizations may purchase condemned houses to renovate and provide affordable housing options in their community. These organizations often work with local governments, private donors, and volunteers to fund and complete the renovations.

Remember, while selling a condemned house may require more effort and patience, there is a market for these properties. Understanding the types of potential buyers can help in targeting the right audience and crafting a successful selling strategy.

How to Increase the Value of a Condemned House

Increasing the value of a condemned house requires strategic planning and careful investment. First and foremost, it’s crucial to understand why your house was condemned. Condemnation usually results from severe safety issues or building code violations. These could range from foundational issues, electrical problems, and hazardous materials, to other structural problems. A thorough understanding of these issues is the first step toward addressing them. Here are a few key steps that can help enhance the value of such a property:

- Invest in Essential Repairs: The most effective way to increase the value of a condemned house is to invest in necessary repairs. These will vary depending on the property and might include repairing structural issues, upgrading the electrical system, addressing plumbing issues, or removing health hazards like asbestos or mold. However, it’s essential to be strategic about where you invest, focusing on those repairs that will have the most significant impact on lifting the condemnation status and increasing the property’s value.

- Consult Professionals: Consider consulting with a real estate agent experienced in selling condemned houses or a contractor with a solid background in renovations. These professionals can provide a realistic estimate of the costs involved in making the necessary repairs and guide you on where your investments would be most beneficial.

- Seek Legal Advice: Legal professionals can guide you through the process of dealing with local government agencies. They can help you understand the specific regulations around selling condemned houses in your area and assist you in lifting the property’s condemned status.

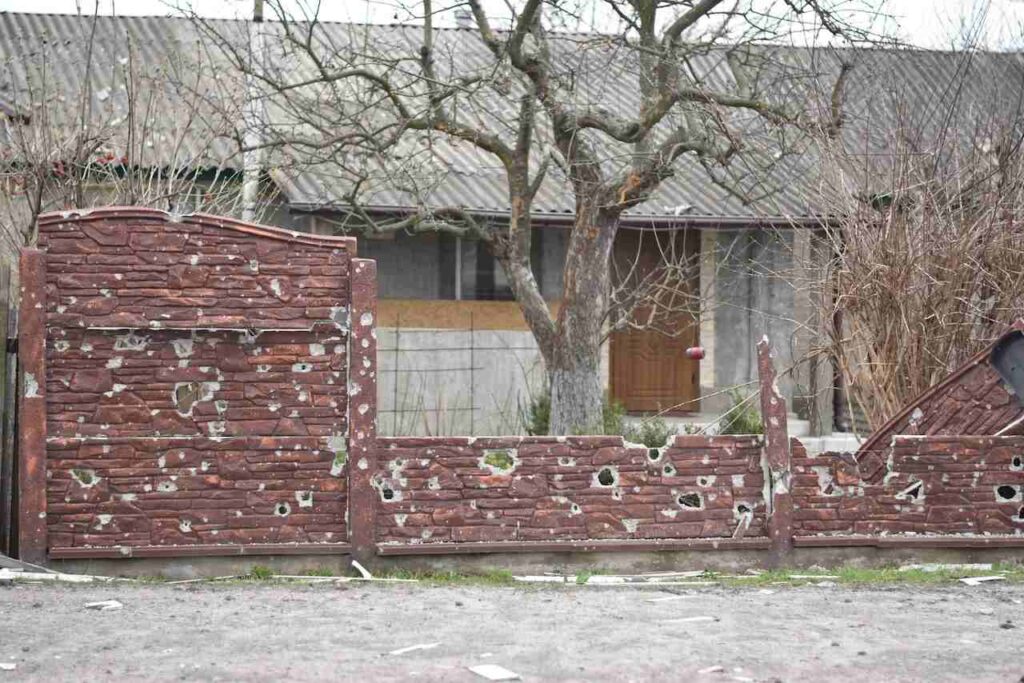

- Improve Curb Appeal: While major repairs are crucial, do not underestimate the power of curb appeal. Once necessary repairs are done, consider investing in improving the property’s exterior. Simple steps like a fresh coat of paint, maintaining the lawn, or repairing the front porch can make the house more appealing to potential buyers.

- Explore Demolition and Rebuilding: In some cases, where the cost of repairs outweighs the potential return on investment, it may be more profitable to demolish the condemned structure and rebuild. This option can be particularly beneficial if the property is in a desirable location. However, this is a significant undertaking and should be considered only after careful analysis of the costs and potential returns.

To Conclude:

So, yes, you can sell a condemned house. The process requires an understanding of why the house was condemned, strategic investment in necessary repairs, professional consultations, and a well-thought-out selling strategy. Increasing the value of a condemned house is a significant part of the process and will ultimately enable you to sell at a high price point.

The process of selling a condemned property is a little challenging, but with the right information and resources, homeowners can make informed decisions that best suit their circumstances. Do you want to sell your condemned house in Tennessee? Talk to the experts at My Tennessee Home Solution.

About My Tennessee Home Solution

My Tennessee Home Solution is a team of local, hard-working, and driven professionals with one goal – to make a difference in the residential real estate market. As a veteran-owned business, our values of loyalty, trustworthiness, and responsibility to every transaction ensure an experience that’s as smooth and straightforward as possible.

We specialize in the off-market acquisition of single-family homes all over the Nashville area, including areas such as Columbia, Gallatin, Goodlettsville, working creatively and enthusiastically to empower homeowners in challenging situations. Whether you’re facing foreclosure, dealing with a burdensome property, or simply need to sell quickly, we are here to provide you with an easy, transparent, and professional solution.

When you partner with My Tennessee Home Solution, you’re not only getting a reliable partner for your property needs but also supporting a business run by veterans who are driven to help others. We believe in the power of community, and through the property market, aim to foster a culture of empowerment, transparency, and mutual respect.

Frequently Asked Questions About Selling Condemned Houses

What is a condemned house?

A condemned house is a property that local government officials have deemed unfit for human habitation. This could be due to serious code and safety violations such as structural damage or significant issues like black mold, which pose a risk to occupants’ health and safety.

How does a house get condemned?

Local officials will inspect a property for any code and safety violations. If these are severe, such as severe structural damage or conditions that pose a serious risk to human health, the property will be considered condemned. A condemned sign will be posted, indicating it is unfit for living.

Can you sell a condemned house in Tennessee?

Yes, you can sell a condemned house in Tennessee, but it’s not as straightforward as selling a typical home. Such properties usually need significant investment for necessary repairs to pass inspection and meet local building codes. However, real estate investors experienced in dealing with condemned properties may be willing to buy the house as is, understanding the repair costs and the process involved.

Who are potential buyers for a condemned house?

Potential buyers for a condemned house are often real estate investors or house flippers, willing to make the needed repairs. These investors pay cash and can close quickly, bypassing the need for a mortgage lender who would likely have concerns over lending on such a property.

How can I increase the market value of a condemned house?

Increasing the market value of a condemned house typically involves making the necessary repairs to meet local building codes and safety regulations. This might include dealing with structural damage, remedying any safety concerns like black mold, and ensuring all proper permits are in place. An investor’s experience and capacity to undertake such work can greatly impact the final selling price.

Do I have to pay closing costs when selling a condemned house?

Yes, sellers typically are responsible for closing costs when selling a condemned house. However, these costs can often be negotiated during the selling process, and some investors may offer to cover them to secure a deal.

Can I sell a condemned house without making repairs

Yes, you can sell a condemned house without making repairs. The property will be sold “as is,” but most buyers will likely be real estate investors who understand the extent of work required and will factor this into their offer.

Will a mortgage lender finance a condemned house?

Typically, mortgage lenders won’t finance condemned houses due to the high risk associated with them. That’s why most buyers of such properties are investors who can pay cash, bypassing the need for mortgage lenders.

What happens if the government seizes a condemned house?

If a homeowner fails to make necessary repairs on a condemned house or defaults on mortgage payments, the local government may seize the property. This is usually a last resort when the safety violations are extreme and pose a risk to the public.

What does it mean to receive a fair offer for a condemned house?

A fair offer for a condemned house takes into account the current state of the property, the estimated repair costs, and the potential market value once the house is brought up to code. Remember that selling a condemned house fast to a cash buyer often means a lower offer, but it also typically includes covering closing costs and a more straightforward buying process.